Although we are amidst the so-called “crypto winter,” we can spot some rays of light that hold a promise for a warmer future. A prominent example is the token economy enabled by Ethereum’s ERC20 ecosystem.

Tokens and their ecosystem

A token represents an asset or utility. For example, we can have a token that represents the number of customer loyalty points. Note that tokens are not necessarily related to blockchains and can be implemented in a centralized manner, like most of the miles you gain when travelling with your favorite airline that are only present within the databases of the airline.

Suppose we have a miles loyalty program and we want to have a vibrant token environment that allows our users to use their miles for any purpose they choose. What are the technical ingredients to establish such an environment?

The essentials:

- Database: Securely storing the users’ tokens

- Database API: Securely sending tokens between users

- Wallets: Providing users with the ability to securely manage their tokens

- Markets: Platforms to securely exchange tokens for money or other tokens

- BONUS Advanced financial services: Liquidity services, collateralized lending services, advanced derivatives based on tokens, tax related services, etc.

Ethereum with its expanding ERC20 ecosystem provides the exactly that:

The database and its API are provided by the Ethereum network itself and its ERC20 token standard; a growing number of wallets in different form factors (mobile, hardware, PC) already support the ERC20 standard and have user communities; There are a few market services, including decentralized exchanges, that support the trading of ERC20-based tokens.

And the bonus parts for ERC20 are getting more extensive by the day, some prominent examples are dYdX for margin trading and derivatives and Dharma for tokenized debt and credit.

It seems that if we would create such a miles loyalty program today, Ethereum and ERC20 would be the natural choice for it and if we have an existing program we should consider migrating it to ERC20.

Case study 1: The Harbor token

Harbor offers a solution for the tokenization of private securities. Using Harbor technology a property owner can tokenize the building she owns, and sell the tokens to the public. That needs to be done in compliance with the relevant regulation that have all kind of requirements for the seller, buyers and tokens. For example, the seller identity and ownership of the property must be validated, the number of tokens may need to be limited and the buyer must be a citizen of the US. Harbor solution checks all that to make sure all transactions are compliant.

Harbor solution is obviously at least somewhat centralized, as all the users (buyers and sellers) needs to be identified by Harbor. So why did Harbor choose to build their solution over the decentralized Ethereum ERC20 stack and not just develop a traditional centralized solution?

One reason is that decentralization and usability is a tradeoff, so hybrid solutions make a lot of sense. We should use decentralization where the solutions are mature, and centralization when they are not ready (or irrelevant) (see our blog )

The second reason is that the Ethereum ERC20 token ecosystem is mature enough to offer many benefits for the solutions that utilize it. By using the ERC20 stack, Harbor could focus on developing only their innovative technology around compliance and get all the other services, such as wallets, database, APIs, markets and advanced financial services for free. Furthermore, as the ecosystem expands (e.g. great new wallets technology) Harbor users can seamlessly enjoy it.

Case study 2: Stablecoins and WBTC

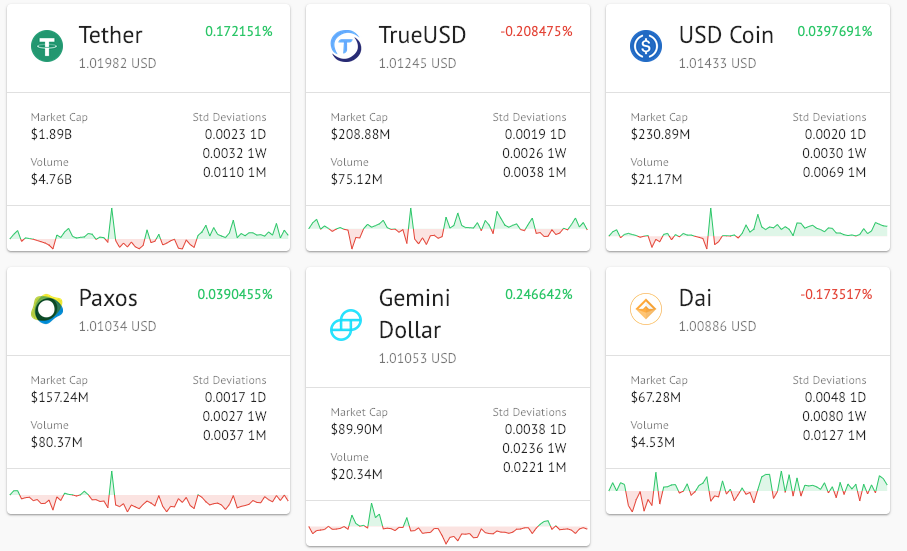

Stablecoins are tokens that are pegged to the value of another asset. The assets can be national currencies (e.g. USD, EUR), commodities (e.g. gold), or anything else with a stable value over time.

Stablecoins are all the rage in the crypto industry right now. Even Facebook is rumored to be developing one.

Almost all new stablecoins are developed over the ERC20 infrastructure and older stablecoins that were created before ERC20 (e.g. Tether) have added support for it.

In fact, the ERC20 ecosystem is so inviting, that “stable” coin versions of other currencies that can be traded directly are created to enable them to enjoy the ERC20 ecosystem. (I’m stretching the definition of stablecoins, as the underlying asset is not stable, but technically it’s similar, as the token is pegged to the value of the cryptocurrency) . Most notably, a few companies in the cryptocurrency community are backing an initiative to release “Wrapped BTC” (WBTC), a Bitcoin (BTC) stablecoin, to allow BTC to enjoy the ERC ecosystem and vice versa.

The Implications

As predicted by Haseeb Qureshi back in 2017, the token economy might be the “killer app” for cryptocurrency. It seems that Ethereum’s ERC20 ecosystem has reached a critical mass to make it the first choice for developers when deploying a relevant fintech solution. And thanks to Metcalfe’s law of networks each new project in this field adds to the power of the ecosystem not linearly, but quadratically. Moreover, as more and more parties rely on the success of the infrastructure, it incentivizes them to nurture it and fix its underlying problems which is great news for Ethereum.

Having said that, Ethereum is not the only gig in town. There are several other emerging blockchains that can support smart contracts and tokens standards and they may pose an attractive alternative due to their enhanced capabilities.

Therefore, the token economy shows great promise for the entire cryptocurrency community.

[Disclosure: I own some ETH]