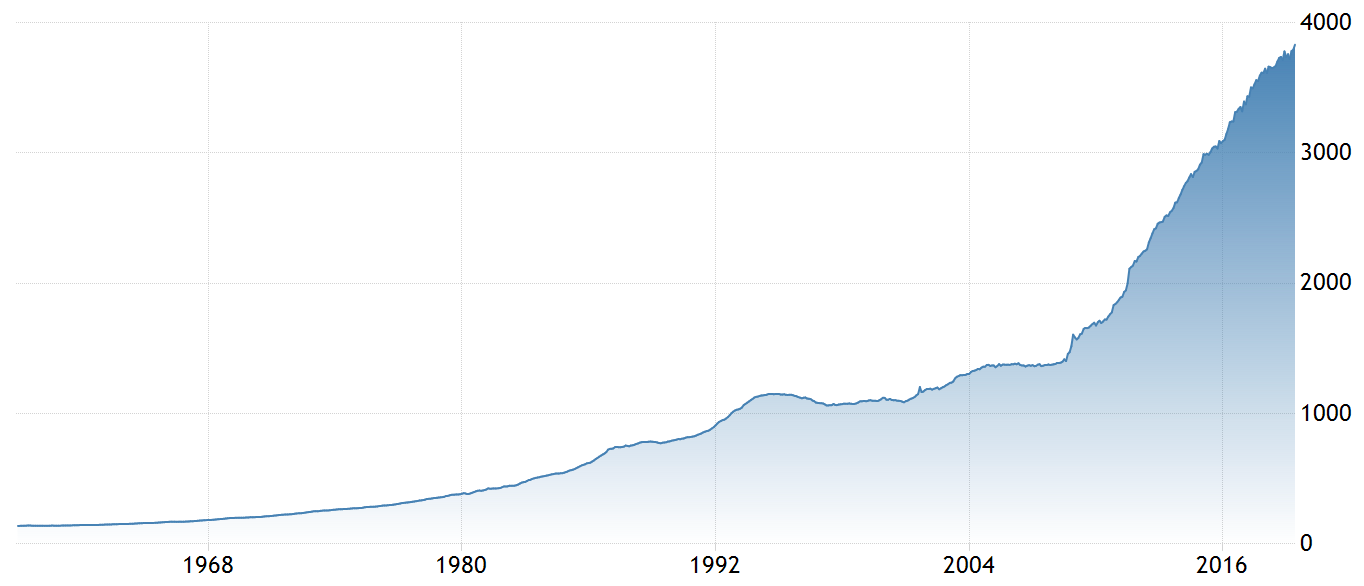

The great financial crisis of 2008 caused the global economy to grind to a halt. It was diagnosed as a liquidity problem, so the Federal Reserve responded quickly with a $600 billion “quantitative easing” program. Over the next four years, the Fed injected another $4 trillion into the economy.

Reverberations of the crisis spread beyond US borders and central banks around the world responded with their own quantitative easing programs.

Based on the stated goal of preventing another systemic shock, quantitative easing was a success. The defibrillator worked. The economy recovered and in many aspects is thriving today. So what’s the problem?

Economic financialization

Central banks have become the biggest players in the stock market. Value investing is passé. Interest rates and stimulus packages drive equity valuations now. Just the narrative around what the Fed will do in the future, termed “forward guidance” — a new tool created by the Fed post-2008 because its existing toolbox wasn’t effective enough — can move the markets more than any other traditional economic indicator. This is unprecedented.

Financial engineering

Another side effect of this new monetary zeitgeist is corporations hoarding all of the cheap capital provided by central banks. Companies now hold a record $3 trillion in cash and are increasingly reluctant to spend it.

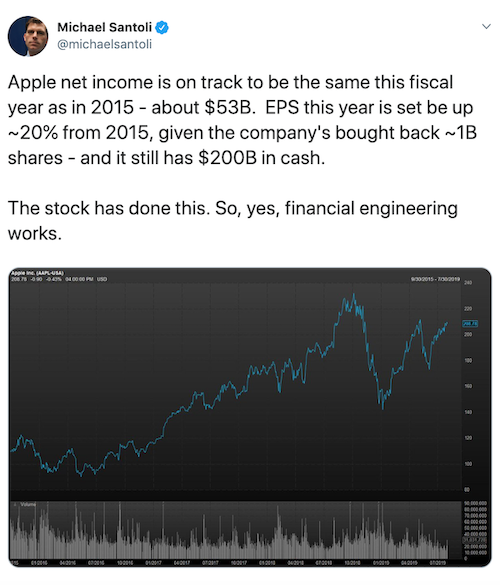

One thing central banks can’t control is how companies spend their money, so instead of investing in initiatives that benefit the broader economy (and their own long-term growth), corporations have been using the stimulus funds for stock buybacks, acquisitions, and other balance sheet arbitrage to boost their stock prices.

Take Apple for example. Its net income has not changed in four years, but because it bought back 1 billion shares and has a $200 billion war chest, its earnings per share (EPS) have increased by 20% in that time.

Shareholders are ecstatic. Little benefit for anyone else.

Can we put the “trickle down economics” myth to bed yet?

Debt

All of this quantitative easing, financial stimulus, or however else it is branded, has encouraged governments, corporations, and individuals to put everything on credit. Global debt is at an all-time high of $244 trillion, equivalent to 318% of GDP.

Why not? Easy money at rock-bottom rates. Everyone’s doing it.

What started as emergency government action has turned into permanent government policy. Wall Street loves the status quo because it’s great for stock prices, and politicians are happy when Wall Street is happy. The likelihood of policymakers changing the system voluntarily is close to zero at this point.

This is the water in which we swim.

Until there’s no choice but to change.

Paradigm Shift

This story has been gaining more attention recently. The best analysis I’ve read so far is by Ray Dalio, founder of Bridgewater Associates, the largest hedge fund in the world.

In this epic opus he dropped a few days ago, Dalio says that we’re approaching a “paradigm shift”.

According to Dalio, continuing the loose monetary policy of the past decade is unsustainable. Moving forward, central banks will find it difficult to lower rates because they’re already at or near 0%. In addition, quantitative easing is losing its efficacy because corporations don’t invest the money in the broader economy. All this means that more aggressive forms of easing, such as currency depreciations and debt monetization, are increasingly likely.

It’s worth quoting Dalio here directly:

“I think that it is highly likely that sometime in the next few years, 1) central banks will run out of stimulant to boost the markets and the economy when the economy is weak, and 2) there will be an enormous amount of debt and non-debt liabilities (e.g., pension and healthcare) that will increasingly be coming due and won’t be able to be funded with assets. Said differently, I think that the paradigm that we are in will most likely end when a) real interest rate returns are pushed so low that investors holding the debt won’t want to hold it and will start to move to something they think is better and b) simultaneously, the large need for money to fund liabilities will contribute to the ‘big squeeze.’”

Basically we’ve spent the past decade financing a world in which we can no longer afford to live.

Dalio then gets to the crux of the matter, saying that, “In such a world, storing one’s money in cash and bonds will no longer be safe.”

As currency values and debt returns decrease, creditors will eventually need to look for safer and more profitable horizons.

In conclusion, Dalio says, “It is also a good time to ask what will be the next-best currency or storehold of wealth to have when most reserve currency central bankers want to devalue their currencies in a fiat currency system.”

His answer: gold.

An Alternative Store of Value

Dalio did an amazing job describing the complexities of the paradigm shift in his characteristically succinct and accessible style. But he ignored the elephant in the room. There’s another powerful paradigm shift unfolding at this very moment which, coincidentally or not, rose from the ashes of the financial crisis a decade ago. I’m talking about Bitcoin.

Over the past decade, Bitcoin has grown from a handful of tinkerers to a global phenomenon, currently worth nearly $200 billion. Most people in the Bitcoin community initially envisioned it as a medium of exchange, akin to a global currency. Since then, the vision has shifted toward a staged evolution beginning with a store of value — similar to gold — and only when mass adoption and price stability is reached will it begin to become a medium of exchange. This shift in vision was mainly a pragmatic realization that no one wants to spend an asset today that might be worth a lot more tomorrow.

Much ink has been spilled on the differences and similarities between Bitcoin and gold. I’ll just briefly summarize here the reasons why I think a ten-year-old technology has a fighting chance against an established commodity that’s been around for thousands of years.

1. Bitcoin has more potential utility than gold

In addition to being a store of value, gold has a functional utility as a precious metal used in jewelry, manufacturing, medicine, and more. But it will never return to its ancient status as a medium of exchange in today’s globalized world, simply because of physics—it weighs too much. The utility of Bitcoin, on the other hand, is its potential to one day become a fast, cheap, borderless medium of exchange because in addition to being a store of value, it weighs nothing. So at the moment, Bitcoin’s utility is admittedly speculative, but its potential utility is orders of magnitude larger than that of gold.

2. Bitcoin is more scarce than gold

Gold continues to be mined from the earth every year and its scarcity is technology-dependent, meaning that scarcity could significantly decrease with better technology. On the other hand, the Bitcoin code limits the total supply to 21 million. It is the only asset in the world that is deterministically limited, meaning there’s mathematical proof of exactly how much of it will ever exist. Mathematical scarcity is much more valuable than technological scarcity.

3. Bitcoin is quickly gaining in popularity among millennials

Nearly one in five millennials prefer Bitcoin to gold according to a recent survey. That might not sound impressive, but this represents a 19% increase from two years prior. It makes sense that millennials’ interest is growing. They’re a disenfranchised generation swimming in debt who see our political system as a scam. From their perspective, their future has been stolen from them to pay for the present.

Where can they invest? Equities at this point are the most expensive they’ve ever been. Savings accounts are a joke. Bonds have no yield. Real estate is unaffordable, at all time highs. How can millennials grow their wealth when all investments have negative imputed returns for the next several decades? Which brings me to my final point.

4. Bitcoin has a much better risk-reward ratio than gold

If Bitcoin were to gain just 10% of gold’s $8 trillion market cap, that would put Bitcoin at roughly $45,000 per coin, or 500% higher than its current value. And that’s against gold alone. The total market cap for all investable assets in the world including debt, equities, derivatives, commodities, real estate, etc. is well over $1 quadrillion. That’s a lot of potential upside for Bitcoin assuming it takes even a small percentage from these markets.

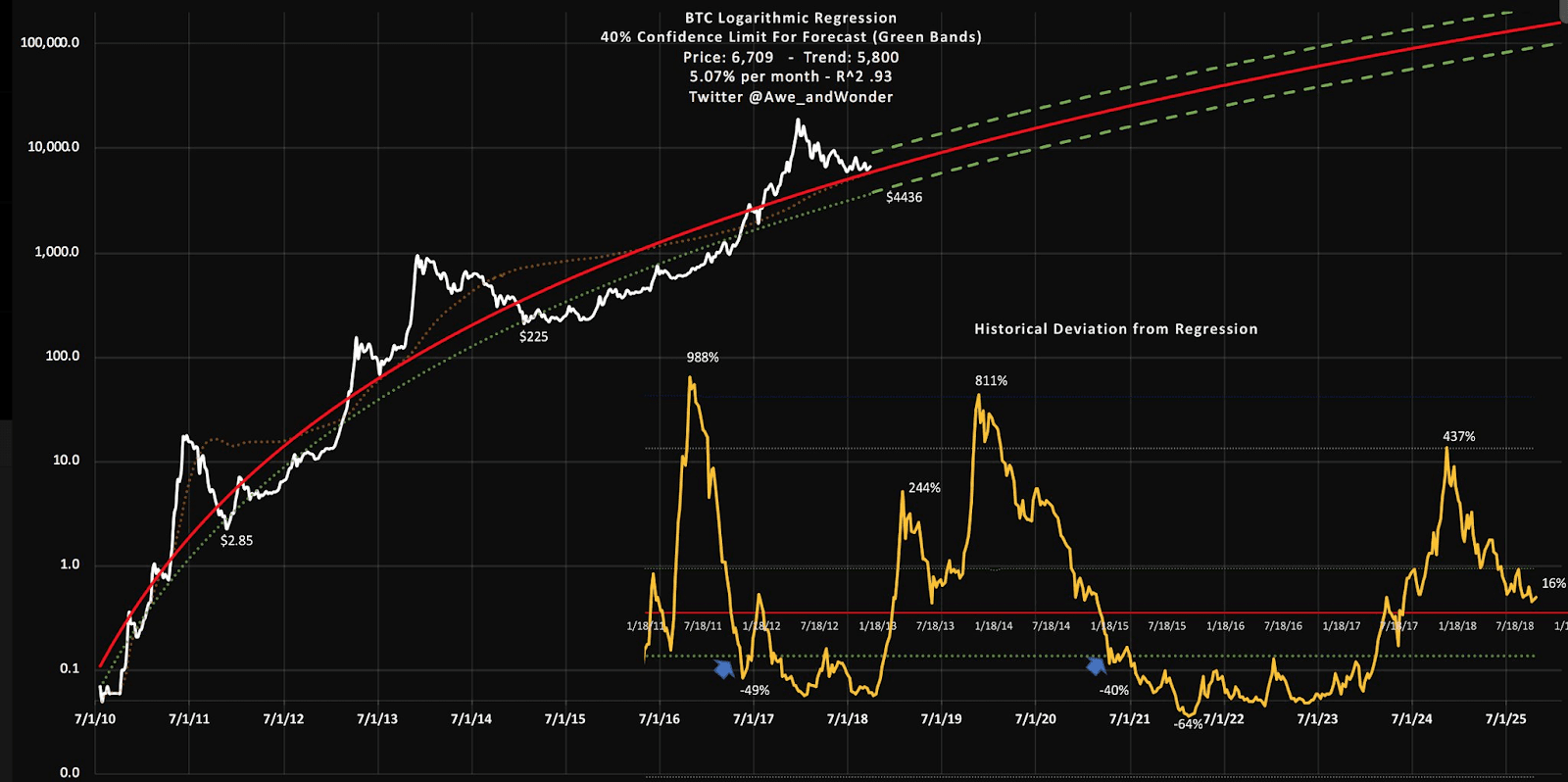

The chart above shows the historical price of Bitcoin on a logarithmic scale (the only way any exponential technology should be viewed). If nothing changes, we should see $100,000 Bitcoin in five years. If there’s a paradigm shift, as Dalio suggests, we can expect to reach that mark much faster.

The search for yield in a stagnant financial world will likely push investors further and further out on the risk curve, which could be a strong catalyst for Bitcoin’s next bull run.

What This Means for the Crypto Industry

There will be a massive influx of new users in the coming years, and it is crucial that the industry be prepared to receive them. This means that fiat-to-crypto onramps, e.g. products and services that facilitate the purchase of Bitcoin with a credit card or bank transfer, is the highest priority layer in the ecosystem right now.

The target customer for this paradigm shift will be financial institutions, retail investors, and average consumers looking for an alternative store of value — not techies, gamers, or anti-establishmentarians. These people just want a simple way to acquire Bitcoin and store it securely.

Note that I have not been talking about “crypto” in general because in my opinion, Bitcoin is the best store of value and I think most people in the space would agree. However, I’m personally very bullish on the many other use cases for crypto assets and there will surely be a spillover effect. This will be good for the entire industry.

But let’s stay focused.

There are several decent onramp services out there today, but many of them are still too technical, confusing, and intimidating for the average user. We need to build products and services that focus less on the technical aspects of blockchain and more on ease of use.

We also need to adopt familiar language from the traditional financial system rather than trying to invent new words that no one understands. And we need to shape the narrative.

Dr. Ben Hunt at Epsilon Theory has done a lot of amazing work around the influence of narrative in the financial markets. The paradigm shift described above is far from what you hear in the mainstream media — what Hunt calls the “Fiat News”. As an industry, it is our duty to counter the traditional Financial Asset Appreciation = Economic Strength narrative with the new paradigm narrative so that people can learn about the alternatives and get ready for the road ahead.

Buckle Up

The convergence of these two paradigm shifts — global financial instability and Bitcoin — has the potential to spark an economic transformation the likes of which hasn’t been seen since the invention of fiat money 1,000 years ago.

“You can’t depend on your eyes when your imagination is out of focus.” ― Mark Twain

There’s a parable where an old fish swims past a couple of younger fish and says, “Hey fellas, how’s the water?” As they pass, one young fish looks at the other with a puzzled look on his face and says, “What’s water?”

The first step is to understand where we are. Look around. See the writing on the wall. Then, once it sinks in, tell everyone.

This is crypto’s watershed moment.